cryptocurrency: price action strategies for Dogecoin trade (Doge)

Dogecoin, a popular cryptocurrency currency and memes, has been operating at the forefront of the digital asset market. With its relatively low price action compared to other cryptocurrencies, it is essential to identify key patterns and strategies to successfully trade. In this article, we will explore some effective pricing strategies for Dogecoin trade, together with an integral guide on how to apply them.

Understand the price action

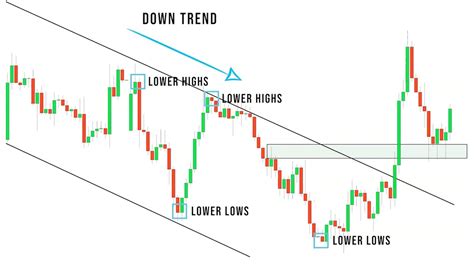

The price action refers to the visual representation of the price movement of a cryptocurrency, including trends, support and resistance levels, and volatility. Effective operators must be able to recognize and analyze these patterns to make informed decisions. When it comes to merchant Doge, you must focus on the following key aspects of your price action:

* TRENDS : Identify long -term trends by examining the price address for prolonged periods.

* Support and resistance levels : Locate potential support and resistance levels where prices tend to bounce or reverse.

* Volatility : Analyze volatility indicators, such as volume and negotiation range, to measure the feeling of the market.

Price action strategies for dogas trade

Here are some effective strategies to exchange dogcoin:

- Mobile average crossover

: This strategy implies buying when the short -term mobile average is crossed over the long term (MA).

- Next Tendency : Use technical indicators such as RSI, MacD and Bollinger bands to identify trends.

- Rank range : Identify a range within which prices tend to fluctuate between support and resistance levels.

Example: mobile average crossover

Suppose you are looking at Doge’s pricing table and observes that the MA in the short term (7 days) is about to cross over the MA in the long term (21 days). You can take a long position when this crossing occurs, since it could indicate a potential trend up.

| Date | MA in the short term | MA long term |

| — | — | — |

| April 1 | 100.50 | 120.00 |

In this example, the crossover occurred on April 4. If you had to buy at the price level of $ 0.070 in Dux when it crossed above the MA in the long term, it could sell at the same price level if it falls below.

Example: Next trend

Suppose Doge’s pricing table shows a downward and MA tendency in the short term (7 days) is about to cross below the MA in the long term (21 days). You can take a short position when this crossover occurs, since it could indicate a potential investment in the trend.

| Date | MA in the short term | MA long term |

| — | — | — |

| April 1 | 100.50 | 120.00 |

In this example, the crossover occurred on April 4. If you had to sell at the price level of $ 0.070 by Dux when it crossed below the MA in the long term, you could buy at the same price level if it rises above.

Example: Rank trade

Suppose you are looking at the dogle prices table and observe that it has broken a resistance level (50 days). It can take a long position when this occurs, since it could indicate an ascending trend. However, you must also be prepared to sell your positions if the trend is reversed.

| Date | MA in the short term | MA long term |

| — | — | — |

| April 1 | 100.50 | 120.00 |

In this example, the level of resistance was reached on April 4. If you had to buy at the price level of $ 0.070 in Dux when it crossed above the MA in the long term, it could sell at the same price level if it falls below.

Conclusion

The price of price shares is a crucial aspect of cryptocurrency markets, and Dogecoin is no exception. By dominating key concepts such as trends, support and resistance levels, volatility indicators and mobile averages, merchants can make informed decisions and increase their chances of success in this space. Remember to always be aware of the feeling of the market and adjust your strategies accordingly.